By Society Insurance Team, reposted with permission from Society Insurance

The continued impact of extreme weather events isn’t lost on businesses: according to one report, businesses can expect to see roughly $13 billion in flood damage in 2022. Tornados, derechos, and severe thunderstorms all threaten billions in damage, but with spring just ahead, let’s focus on how you can protect your business from the threat of flooding.

Businesses everywhere are susceptible to flood damage—so how can they prepare? Below, we’ll cover five flood-readiness essentials that your business should consider.

Use Natural Landscaping Techniques Around Your Business

Large paved areas such as surface parking lots collect water, and only have limited areas for drainage. Plus, if your community is flooding, these drains in your parking lot may be overwhelmed to a point where they aren’t helpful. Surrounding your building with a variety of shrubs, natural grass or bushes can help absorb excess water during floods.

Rain gardens, for example, are a type of landscaping that collects runoff rainwater. They can divide parking lots, flank walkways or be embedded into grassy areas. Additionally, incorporating an appropriate mulch into landscaping around your business can help protect your business’ foundation and exterior by slowing and absorbing water.

Make Sure Your Gutters Are Clear

You should clean your gutters twice a year, and spring is one of the best times to do so. Cleaning your gutters ensures they’re clear of debris that could prevent proper drainage. If your gutters aren’t clear, water can collect on your roof or in the gutters themselves, weighing them down and potentially causing costly damage to your building.

Don’t forget that directing your downspouts and drains away from your business’ foundation is just as important as clearing your gutters of debris. When high volumes of storm water is draining from your gutters, it should be diverted away from your building. If it pools at the base of your building, it can cause significant damage to your building’s foundation.

Flood-Proof Your Building’s Most Susceptible Areas

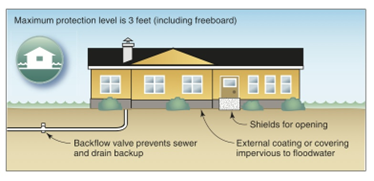

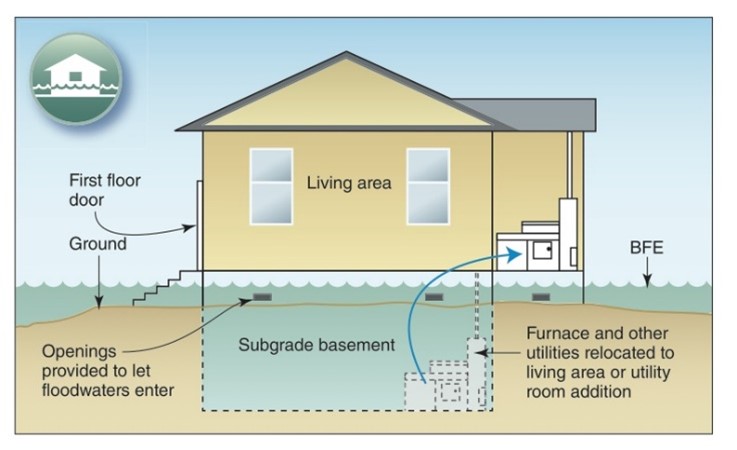

The lowest point of elevation in your building should ideally be above the highest point expected in a flood. By learning your building’s base flood elevation (BFE), you can identify the areas of your business that are most vulnerable to floods. From there, you can determine what flood-proofing techniques will be most beneficial depending on your property’s level of risk.

If there are important areas below your BFE, dry floodproofing techniques can involve impenetrable barriers, plates or coatings that prevent flood water from entering your property. On the other hand, wet floodproofing is a technique where highly-durable areas are designed to allow water through, in effect creating a path of least resistance in order to protect your property.

Shore Up Your Foundation

Floods or torrential rainfalls can cause significant damage to your foundation. Water is incredibly powerful; when it seeps into your building, it can expand existing cracks and displace walls. Overall, when a building is subjected to flowing or standing water, the structural integrity can be damaged, leading to burdensome repair or rebuild costs.

Use caulk and other sealants to ensure the locations where pipes enter your building are sealed. Consider hiring a contractor to assess and restore existing damage in your basement or foundation before spring thaws or floods.

Use Water Detection Devices

Water detection devices can monitor moisture levels around your building. If there’s flooding, they can alert you to areas where water is seeping in so you can triage these places and protect anything that could be damaged before it’s too late.

Be Prepared to Weather the Storms

Spring is a time of new beginnings but it’s also a time of risk: melting snow unable to be absorbed by the still-frozen ground, heavy seasonal rains, and other environmental factors can lead to Spring floods. Being prepared for these risks can be the difference between a profitable spring and a summer spent recovering from it.

Contact Brian Fowler, WisMed Assure Account Director, at 608.442.3718 for a quote or with any questions.

Reposted with permission from Society Insurance