By Chris Noffke, GBDS, CSFS, Vice President of Employee Benefits

As many independent physicians know, health insurance costs are high – and keep climbing! To help alleviate some of these increases, we suggest using strategies like Health Savings Accounts (HSA) and Health Reimbursement Accounts/Arrangements (HRA).

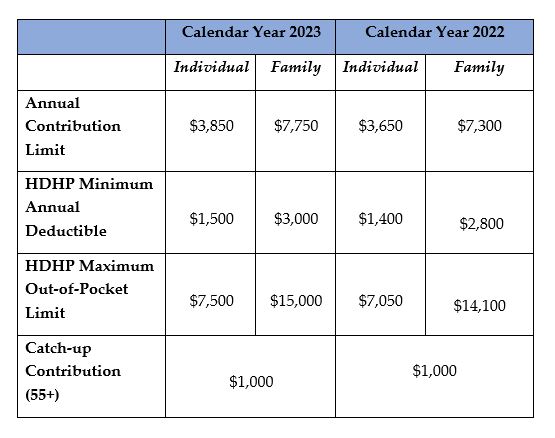

The IRS recently published the approved contributions and plan allowances for HSAs in 2023, and things are changing. The biggest change is that plans that currently qualify for an HSA with a $1,400 deductible will no longer qualify for HSA contributions in 2023. To qualify, health insurance plans will be required to have a $1,500 deductible for an individual (or $3,000 for a family) to contribute to the HSA.

Reference Chart for High Deductible Health Plan (HDHP):

Recently I worked with a physician who retired with more than $200,000 in his HSA. He stated that he was lucky to have listened to a professional to start this type of account. He now has an account to take tax free and penalty free distributions to pay for qualifying medical expenses at any age. Unlike many retirement accounts, HSA distributions are discretionary rather than required. Plus, after age 65, he can use the account for non-medical expenses penalty free. That means the HSA is taxed just like a traditional IRA, 401(k) or 403(b) for non-medical retirement income.

How did he build this nest egg? He used proper strategies which allowed him to take tax deferred dollars and invest them in mutual funds and other investment accounts.

Want to know more about how this strategy and other solutions help you plan for success? Let’s talk! Give me a call at 608.442.3734.