By Mark Ziety, CFP®, AIF®, Senior Advisor, WisMed Financial

Uncle Sam is part of your family, even if you are single. From time to time, you may have wondered if there are ways to reduce your tax payments to him. There are ways, so let’s have a quick tax lesson and then explore a couple options.

We have a progressive income tax structure in the US. As you earn income through the year, your first dollars are taxed at the lower tax rates. As you earn more and more, the last few dollars are taxed at higher tax rates. The highest rate is called your marginal tax bracket. Most people think every dollar is taxed at their marginal tax bracket, but it is only the last few dollars earned. Here is a short video that provides a bit more detail.

During your working years

If you are just starting out, have modest income, and are still in a lower tax bracket, then paying taxes now is generally preferred. One way to do this is to make Roth contributions to your 401(k) or 403(b). In contrast, if you are in your peak earning years and need a tax deduction, traditional/pretax contributions to your 401(k) or 403(b) is preferred. This reduces your taxable income today and kicks the tax can into the future when you may be able to pay it at a lower tax rate.

Between retirement and age 72.

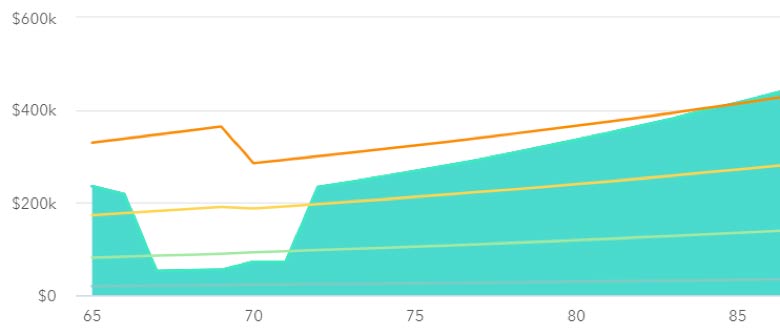

Quite often, there is dip in taxable income (and therefore tax bracket) after retirement. However, taxable income may climb right back up again at age 72 when required minimum distributions start. The years between retirement and age 72 are the key tax planning years to reduce lifetime taxes. By accelerating income into these low tax years, typically using Roth conversions, you can reduce your lifetime taxes. Please see Chart 1.

Chart 1. Ordinary income tax brackets at various ages

Green = taxable income

Lines = income tax brackets

In addition to these strategies, taxes can be reduced by using tax efficient funds, making timely charitable gifts, locating investments in the right types of accounts, and more.

For personalized help with your tax planning, please contact me.

Mark Ziety, CFP®, AIF® 608.442.3750.

WisMed Financial, Inc. part of the Wisconsin Medical Society