By Mark Ziety, CFP®, AIF®, Senior Advisor, WisMed Financial

With more than 2,700 rules and 567 separate filing strategies for Social Security, 96% of people fail to make the optimal claiming decision and miss out on $111,000 of benefits for the average household.1

$111,000 – that’s a lot of money. Let’s look at some of the rules for Social Security so your decision is better informed.

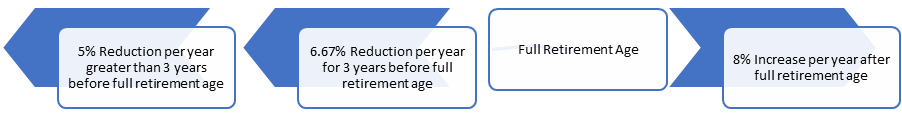

- Normal benefits: Benefits can be claimed between ages 62 and 70. The longer you wait, the larger your check. However, the increase is not linear. In fact, the growth is backloaded thereby encouraging people to delay.

- Spousal benefits: Married people can claim a spousal benefit worth up to 50% of their spouse’s full retirement age benefit if it’s larger than their own and their spouse has started their benefit. As above, spousal benefits are reduced before full retirement age. However, they do not increase after full retirement age.

- Divorced benefits: Divorced spouses can also claim a spousal benefit if the marriage lasted at least ten years and they are unmarried at the time they file for spousal benefits.

- Survivor’s benefits: Spouses and surviving divorced spouses can receive the deceased spouse’s benefit starting at age 60 if the marriage was at least nine months (married) or ten years (divorced).

- Withheld benefits: Benefits may be withheld if you are under full retirement age and still working. Once you reach full retirement age, the amount will be recalculated to include previously withheld amounts.

- Taxable benefits: 0% to 85% of Social Security benefits may be included in taxable income. The higher your total income, the more of your Social Security you’ll owe tax on.

Optimizing Social Security also requires coordination with retirement investments, something most Social Security calculators omit. For instance, if you retire at age 65 and delay Social Security until age 70, you’ll spend your retirement investments while you wait. It may make sense to start Social Security earlier, even though the amount is less, allowing you to preserve your investment nest egg.

For many people, it’s wise to get professional help to determine the optimal timing for Social Security. Get it right and it could be worth $111,000.

The Social Security Timing Guide in our resources has even more details. Or, for one-on-one help schedule an appointment.

For personalized help eliminating debt, investing smart and securing retirement, please contact Mark Ziety, CFP®, AIF® 608.442.3750.

1. The retirement solution hiding in plain sight. InvestmentNews. (2020, June 12). Retrieved August 4, 2022, from https://www.investmentnews.com/whitepapers/the-retirement-solution-hiding-in-plain-sight