Never fear… WisMed is here

By Chris Noffke, GBDS – VP of Employee Benefits

November is coming and so too are your updated employee health plan costs… if the carriers are up to speed!

Regardless, it is time to start thinking about and planning for open enrollment. In addition to being prepared so that employees have the time, information, and support they need to select a plan that best fits their needs, here are some important changes you need to know;

- 2021 affordability percentage is 9.83%, up from 9.78% (This applies to groups of 50 or more employees)

- Out of Pocket Maximums for 2021: $8,550 for self-only coverage and $17,100 for Family

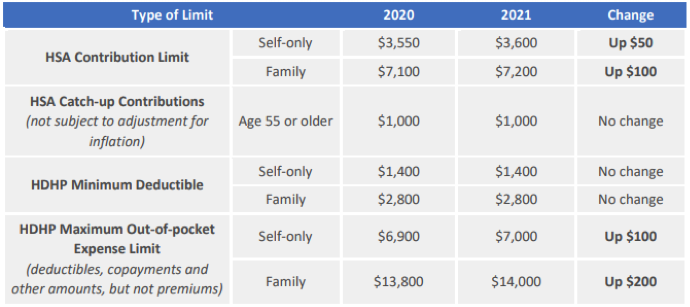

- HDHP and HSA Limits for 2021 (see chart)

Compliance, compliance, compliance… talk about fun!

In all seriousness, here is a reminder of when to submit your ACA Disclosures and Notices:

- Special Enrollment Notice: Initial Eligibility and each Open Enrollment and also must be in SPD (Summary Plan Description).

- SBCs (Summary of Benefits and Coverage): Required 30 days prior to new plan. Must be provided during each annual enrollment. If an employee must enroll to continue coverage, the SBC must be provided when open enrollment materials are distributed.

- CHIP Notice: Annually, before beginning of plan year. Recommend to include with Open Enrollment materials and upon initial eligibility.

- Medicare Part D Creditability: Must be sent before October 15, regardless of your plan year.

- Women’s Health and Cancer Rights Act (WHCRA): Annually & upon initial enrollment / Usually sent at Open Enrollment.

Market Updates

General opinion on this year’s premium increase range widely between 4 and 10 percent for group benefits.

As to trends in plan design in response to COVID, a survey conducted by Mercer in June found that 37 percent of employers do not anticipate adjusting benefits for 2021. It also found that 48 percent are taking a wait and see approach.

While waiting to see what plans will actually cost, I believe we need to be mindful of what’s almost certain to occur in 2021. Many plans have made gains this year because employees are deferring elective care, but, as COVID releases its grip, it will almost certainly result in a much higher than normal plan usage in 2021.

Some of you may have an opportunity to lower costs if you are willing to change insurance companies. But, look at any “gift horse” very carefully, you could be facing an even larger increase than normal next year if you switch to a company that is trying to grab marketing share. If you are uncertain what to do, but find yourself in a situation where status quo means accepting a significant increase, we should talk.

And, if you would like to discuss how you can prepare now for what’s ahead, contact me.

Open Enrollment Safety

We will still be hosting town hall meetings but will be doing so with COVID-19 safety in mind.

Please contact me to discuss arrangements for virtual enrollment meetings for your employees.

Chris Noffke

608.442.3734 direct

Chris.Noffke@wismedassure.org