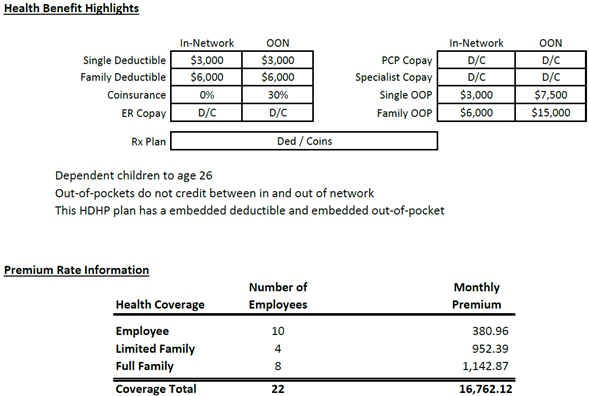

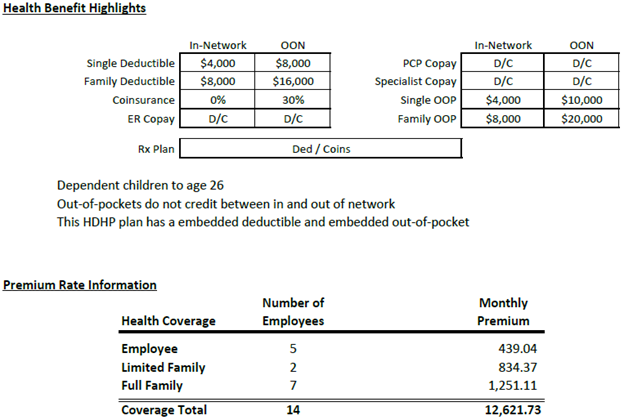

Affordability testing

By Chris Noffke, GBDS, CSFS, Vice President of Employee Benefits

The Affordable Care Act (ACA) brought a lot of extra work to employers and insurance companies. Whether you are pro-health care reform or against it, per the Health Affairs article, the ACA has not made insurance more affordable.

Don’t forget to call your mom – and your insurance agent

By WisMed Assure Service Team

With the intention of easing administrative burden for WisMed Assure client physicians, several of our Medical Professional Liability carriers have significantly reduced or suspended asking for renewal applications over the past few years. While this does save time, renewal applications were an opportunity to touch base, review and discuss any changes to your practice that could impact your premium or coverage.

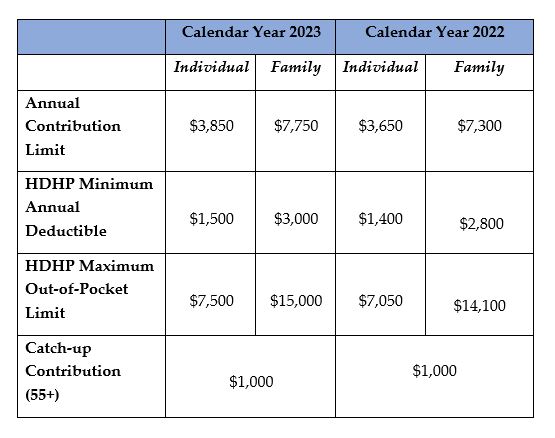

Year-end tax planning for 2022

By Mark Ziety, CFP®, AIF®, Senior Advisor, WisMed Financial

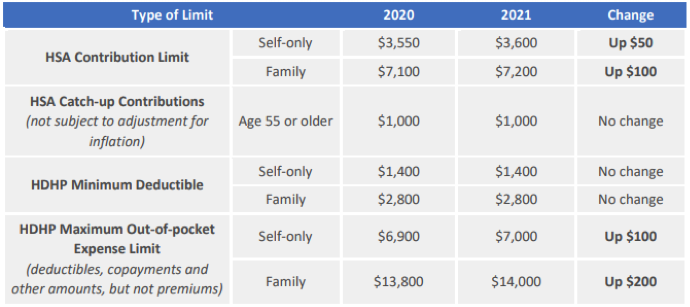

Want to put thousands of dollars back into your pocket? Who doesn’t. Choices you make during your employer’s open enrollment period and for year-end tax planning can really add up.

Graded premium disability? Yes, you can!

By Tom Strangstalien, Insurance Advisor

I recently worked with a young physician to set him up with personal disability protection to provide some financial security if life throws him and his family a curve ball. Prompting our planning was that one of his peers in the general surgery specialty sustained a serious hand injury, ending his ability to perform hands-on surgery.

5 ways to develop inclusive hiring practices

By Society Insurance Human Resources, reposted with permission from Society Insurance

Inclusive hiring practices recognize diversity and embrace a wide range of perspectives that candidates from all walks of life bring to the organization. And according to research from Monster, “Four in five (86%) candidates globally say diversity, equity and inclusion in the workplace is important to them.”